THE LITHUANIAN AND BALTIC STARTUP ECOSYSTEM

The startup revolution is still going on. Great ideas are changing the world as you read this White

Paper. Innovative teams and leaders work in different parts of the startup ecosystem, but, when

you look at the whole process from the investors perspective, repeated problems appear on the

map. Together with opportunities, of course.

●Firstly, it is often better to find new startup treasures in 'developing markets'. For the most part

this is the cheaper option, plus the companies tend to be more ambitious. Countries with excellent

startup infrastructures and an impressive business history are world leaders in making new

businesses big, but the market in these areas is very competitive among investors, where they tend

to fight more fiercely for prospective technologies and people.

●On the other hand, there are many countries where investment risk is not just about the market.

They are often about the unpredictable state of the country, lack of communication infrastructure,

and many other factors outside the established norm of the investment culture

Secondly, there are industries which seem to be highly underestimated and difficult to quantify.

These do not include models such as Uber or Facebook. For example, the IT security industry - the

true weapon of the 21st century - how many unicorns have you heard of in this sector? Is it easy

to mention the biggest and most known companies, with the best track record of experts?

Incubators that allow them to prosper, or maybe die? And critically, who can we trust when

investing in the above mentioned markets? Many tech industries are like this.

Thirdly, the startup world has always been easier for venture capitalists. Most of the really

significant funds risk a lot with big money. However, this sphere of investment is highly aware that

most of the startups they may invest in can easily lose money and slide into bankruptcy. On the

flip side, they can also afford to conduct intensive examinations of the startup team, invite expert

advisors to help them understand the prospects, including pitfalls of the startups, and engage in

long, complicated and expensive paperwork and administration while initially choosing and

operating the start up.

Nowadays there are also many private investors who possess a strong desire to help startups

create great products. On the down side, they don't possess the same financial clout as the bigger

players to research and invest in technologies, markets, and the startup team. Every investment is

a risk and may be highly crucial to the private investor.

WHY LITHUANIA? WHY ICO?

●Let's start with the country in which we operate. Lithuania is a member of EU since 2004, and a

member of the Eurozone for more than 3 years. According to the Doing Business 2018 World bank

report, Lithuania is ranked 16th in the world as possessing a unique business-friendly atmosphere,

and the World Economic Forum ranked Lithuania as No. 1 in the most inclusive emerging

economies (Inclusive Development Index 2018 report). It is estimated that the whole Lithuanian

market hosts more than 31,000 IT specialists and more than 14,000 highly talented developers

(according Statistics of Lithuania, year 2016). Lithuania is seen as a good hub in which to relocate

tech genies from Russia and the CIS countries. The number of entrepreneurs who have relocated

from that particular market tend to go Europe and expand and prosper rapidly. We are highly

confident, that in the favourable political and economic climate, this number will grow even higher

in the year to come.

●Our team are vastly experienced in this particular market environment. We are highly focused in

this region having amassed many years working with startups and IT recruitment in and for

Lithuania, with some of our team members actually located in Russia.

●Secondly, underestimated technologies and industries. Our incubator and fund were founded by

Marius Pareščius - a well-known Lithuanian IT and security expert, serial entrepreneur, and IT

counsellor to the Lithuanian Parliament. He has managed dozens of IT, security and internet

projects as both CEO and advisor; working with banks, software development companies, data

centres, web hosting companies, retail, and business associations, across Europe, the Baltic

States, Russia, Ukraine, and Belarus . He, along with his team, are one of the few entities who can

estimate and grow startups in the region because they speak the same language, in every aspect

of the business and investment world.

●Thirdly, our ICO offers to widen the scale for investors. Being a traditional tech-accelerator and

fund at the outset we raised funds from institutional investors and private equity. However, as

fintech is changing rapidly we made the decision to examine new opportunities. All funds being

raised in cryptocurrency will be converted to Euro and invested in the traditional manner.

●But what is different? First of all, for us this is a part of the bigger picture in how we attract money

and how we utilise that money in the most effective and profitable manner. This is not an ICO for

ICO.

THE LITHUANIAN AND BALTIC STARTUP ECOSYSTEM

●According to the recently published Startup Genome 'Global Startup

Ecosystem Report and Ranking 2017' Silicon Valley is no longer the

capital of the Startup World. And, the reasoning is more than simple,

from the very start of the startup hype, every city in the world has

placed its efforts in reaping the benefits of job creation, innovation

and, rapid economic growth. While on an average investment map -

we usually only see Silicon Valley, New York, London, Tel Aviv, Berlin

and some of the bigger capitals, what investors tend to miss are the

much smaller regions that are not only extremely hungry for

innovation, but also focus on learning technical skills.

●Meet the Amber Valley for startups; the Baltics, and Lithuania - the

biggest country of all 3 Baltic States. While being located at the main

crossroads of Western Europe, Northern Europe and the CIS;

Lithuania is the ideal hub for accessing the EU markets and enabling

CIS and Baltic startups to operate there. Today, according 'Enterprise

Lithuania' (a non-profit agency under Ministry of Economy

established to promote entrepreneurship, support business

development and foster export) data, there are over 400 startups

located here, both local and international.

It is no secret that recently, private venture capital from Western Europe, Scandinavia, the UK,

and USA have all actively begun examining the Baltic states as a hugely promising and rapidly

growing tech region. Many of these funds are already engaged in coming to the Baltic States, or

establishing partnerships with some of the biggest local market players, such as BHV.

Since 2007 startups from the Baltic States (Lithuania, Latvia, Estonia) have raised 1 billion Euro

in venture capital. Over 300M Euro was raised via ICO in 2017 in Lithuania and Estonia.

Noteworthy news came from the Bank of Lithuania at the beginning of 2018, stating that ICO is

legal under the country's jurisdiction and only general taxation is applicable. Lithuania is also

particularly noted for the quality of its fintech and cyber security startups. The investments made

in Lithuania were more than 100M Euro in total.

Favourable conditions for the development of financial technologies (FinTech) in Lithuania have

already attracted 32 new domestic and foreign companies that applied for the licence in 2017

alone (Bank of Lithuania data), and the number has doubled compared to 2016. Upon

implementation of planned initiatives for fostering FinTech development, the sector is likely to

attract more investment and create more jobs. More than 100 companies showed interest in

operating in this market. This marks a strong trending curve in the Lithuanian market as the

capital of Fintech in the EU.

Lithuania senses global changes and keeps pace with financial innovations. A perfectly

developed infrastructure, close network of contacts and favourable geographical location provide

proper conditions for competing with other European countries. Vilnius, the capital of Lithuania, is a

dynamic city, friendly and safe for foreigners. The majority of citizens here speak English. Russian

is also quite often heard being spoken on the streets and throughout the city. Our startups tend to

easily facilitate working and living comfortably in such an environment.

STARTUP STATE SUPPORT

●Business Hive Vilnius Incubator and Baltic Fund partner closely with governmental agencies,

such as Startup Lithuania and Go Vilnius, who are responsible for assisting new startups during

relocation and with any startup visa issues which may arise. With cooperative help, residence

permits for startups, including the core team and their families, are being issued in a much faster

period of time. Launching a new company is also the subject of Startup Lithuania support and can

be done in just a couple of days.

●Lithuania also offers startup visas using the immigration law established by the Lithuanian

government to attract innovative startups from across the globe to invest in Lithuania. There are

also additional laws designed for industrial support; e.g. the opportunity to make an e-money

allowance for fintech startups in 3 months (compared to one year plus in both the UK and

Germany).

●

●In addition and according to the Doing

Business 2018 World bank report, Lithuania is

ranked 16th in the world as possessing a unique

business-friendly atmosphere. Also, according

to the World Economic Forums 'Inclusive

Development Index 2018‘ Lithuania has the

No.1 ranking among the most inclusive

emerging economies.

●All this ensures that relocation of promising

startups from Russia, Belarus, Ukraine is an

easy process. Therefore combining the

knowledge of teams working in non-EU markets

with technologies and funding sources - will

create a more than positive outcome with a

more than 4x multiplier.

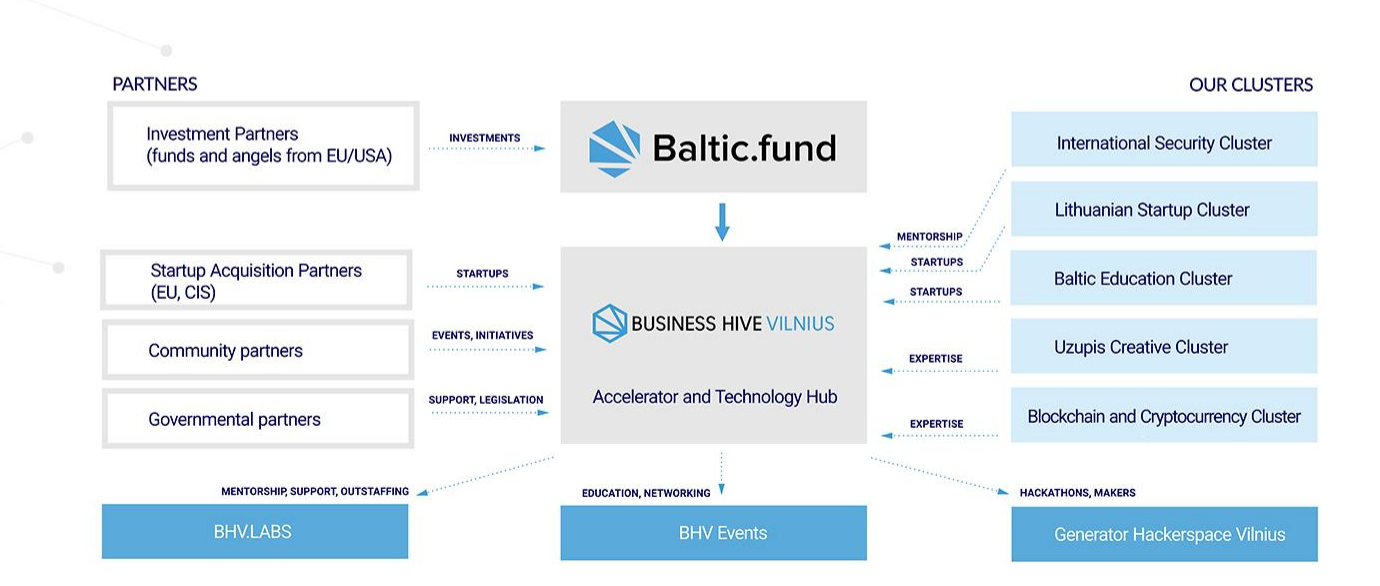

BALTIC FUND AND THE ECOSYSTEM

Imagine an ecosystem, where any startup can obtain the best there is – from their creation till

they exit. We talk here about top-notch level of expertise, support from the governmental

institutions, a chance to dive into the community backed events and initiatives, supervision of best

advisors and many more. This is something we created. And we call it - Baltic Fund Ecosystem.

Lets’ crowd-incubate the startups!

We are building the platform, where you support the startups you like with BALT tokens and get

perks or income for doing this. Be the first one to get the unique products and other benefits from

the most promising CEE and CIS startups!

All the startups, registered at the platform, post a token investors’ proposal:

• how many tokens do they need

• what do they need them for (development, production, marketing, etc.)

• what would they offer their backers in return

So, what startups can offer you for your support:

• their products and services

• partnership and collaboration (help with some of your tasks)

• tokenized loan (they take your tokens, and give them back to you with multiplication after a

certain period, buying BALT tokens at a public crypto exchange)

How startups can participate:

• offline, using our incubator space and its production facilities

• online, using our services and partners facilities

HOW IT WORKS

How does Baltic Fund and NHB incubator help startups for the tokens you invested:

• incubation program with the experts from EU and the US, and our own mentors

• production and engineering facilities, other incubator’s office opportunities

• BHV.Labs’ developers, designers, marketers, PR pros, analysts, engineers, etc.

• venture partners

• and the growing number of new opportunities!

What happens after the incubation:

• startups launch their products (and the contributor gets one)

• partnership and collaboration (help with some of your tasks)

• startups grow and develop (and the price of your investments grow)

An investor gets product and income, a startup develops, we help and manage.

Profit!

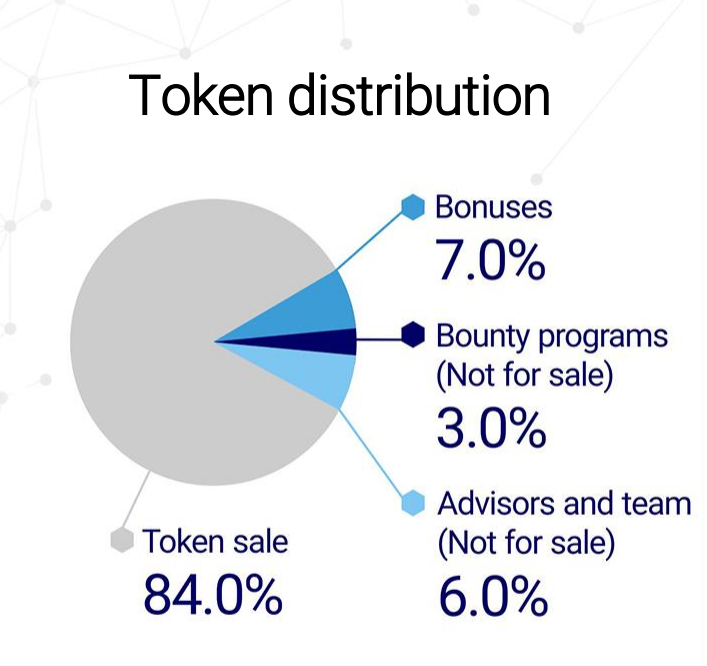

TOKEN DESCRIPTION

Baltic fund tokens:

• 165.000.000 tokens to be issued

• 150.000.000 tokens for sale

• 15.000.000 tokens not for sale (advisors, team, bounty)

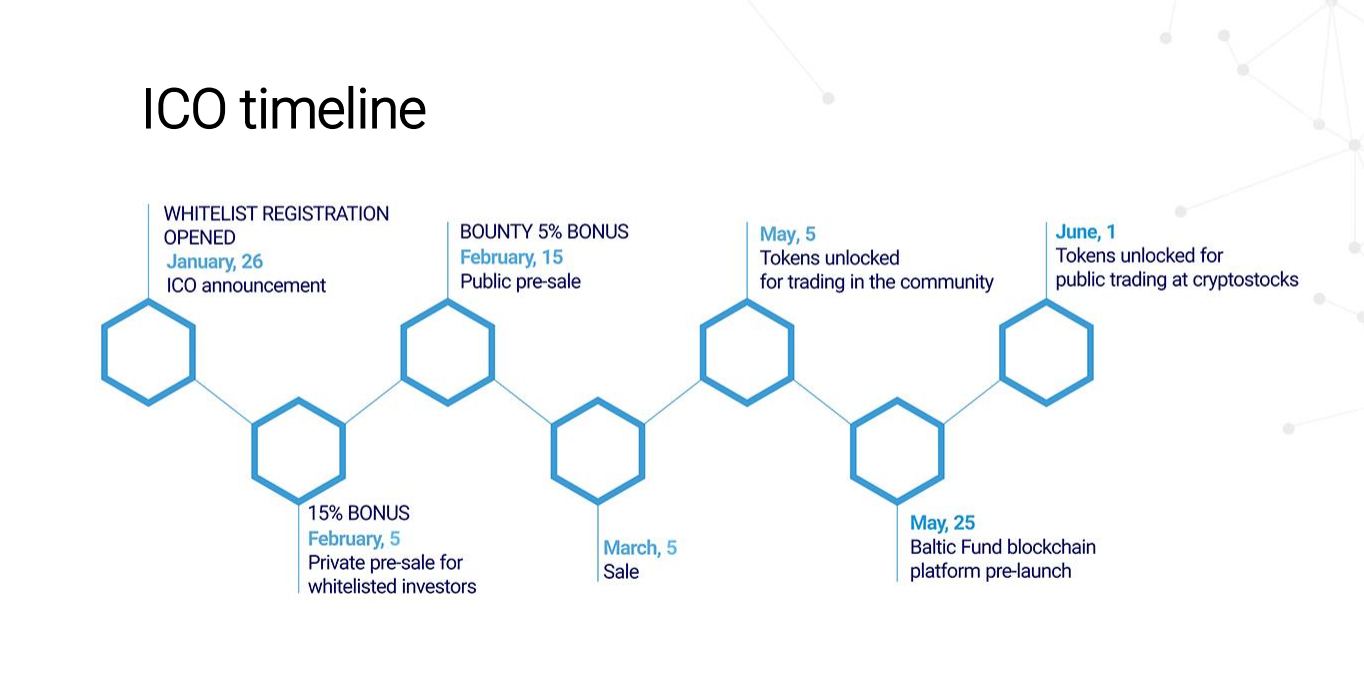

Token price:

• 1 Baltic Fund token = 0,00020 ETH for public pre-sale, 0,00025

ETH for sale

• Minimum amount of purchase – 100 tokens

Bonuses:

• pre-sale – 15% bonus (minimum amount of purchase – 100

tokens, +5% bonus for payments 100+ ETH)

• sale – 10% bonus (minimum amount of purchase – 100 tokens,

+5% bonus for payments 100+ ETH)

TOKEN AND PLATFORM

●Each token-holder can easily become a part of our blockchain based startup ecosystem, no

matter where he or she is located.

●The token allows you to purchase the following services on platform:

● Acceleration (online/offline) for your or your friend’s startup

● Online 1-to-1 consulting sessions with the community mentors/advisors

● Tickets and priority entrance to our events

● Discounts for the most significant global startup events

● Membership (or virtual residentship) in our coworking and discounts at partner’s coworkings worldwide

● Delivery of community events to our city

Or simply sell your token:

● in the community

● at the crypto stock

● back to the platform with multiplicator

You can visit their website for more information:

Website: http://baltic.fund

TELEGRAM: https://t.me/BalticFund

Official THREAD: https://bitcointalk.org/index.php?topic=2981924.0

profile bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1918265

ETH address : 0x553a05A7E022e0c873E0c7cE704FdD57FBfaab9F

Komentar

Posting Komentar